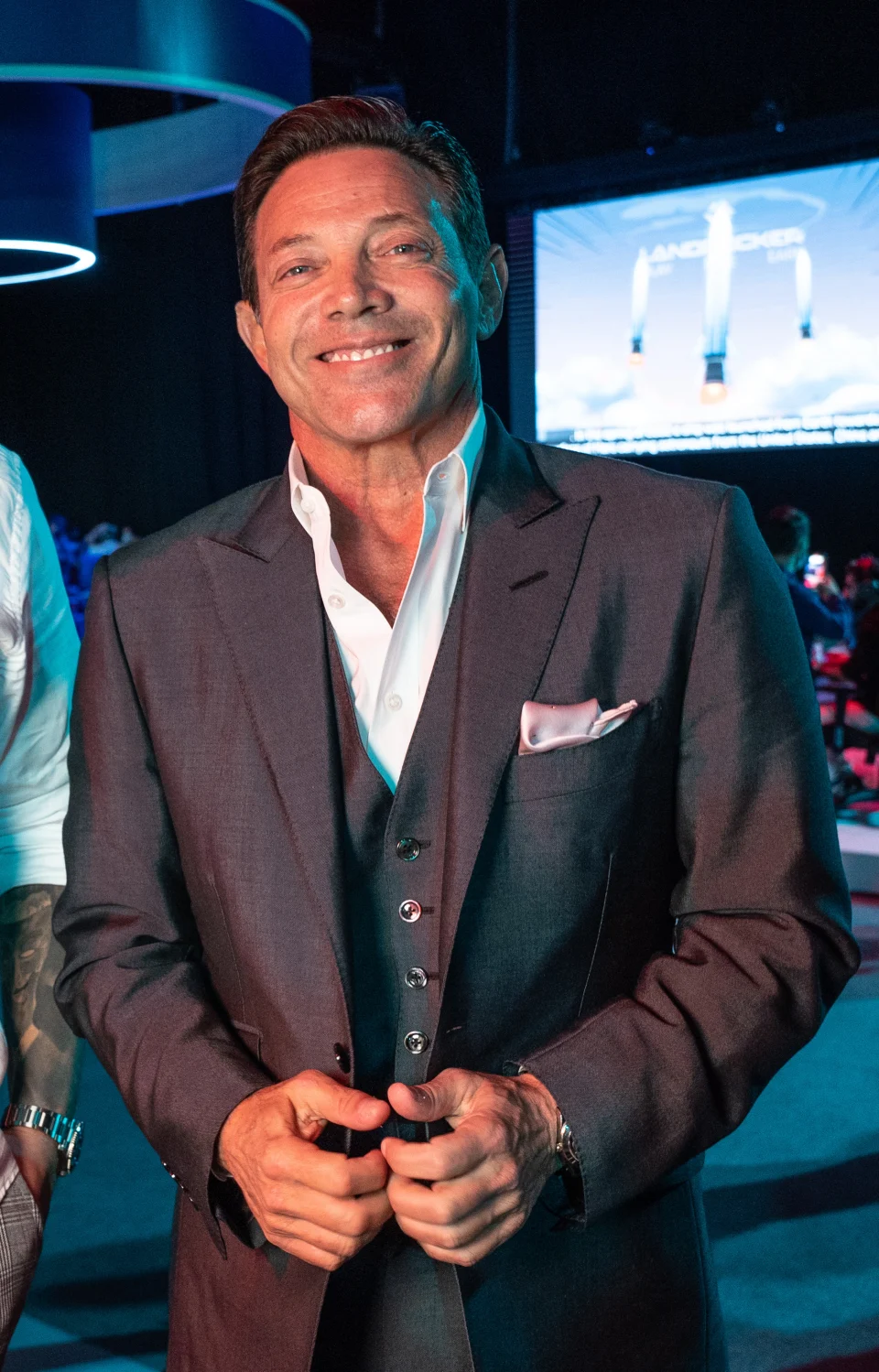

Jordan Belfort, the author of the new book “The Wolf of Investing,” has some salty things to say about Wall Street.

For starters, he described it as a “giant, bloodsucking monster … the Wall Street fee machine complex atop the entire global financial system — extracting excess fees and commissions and creating general financial mayhem.”

Average investors, he added, lose all the time because they are baited by the latest stock tip they hear from a friend or read about on TikTok. There’s more: “Depending on who’s been advising you, there’s an excellent chance that a significant portion of your annual returns are being unnecessarily cannibalized by fees, commissions, and pumped-up annual performance bonuses,” he told me.

You may already be familiar with Belfort. His best-selling autobiography, “The Wolf of Wall Street,” is the basis for the 2013 Oscar-winning film of the same name starring Leonardo DiCaprio. Belfort, a former broker, made loads of dough by peddling shady sales of penny stocks — and turned around and blew it away on drugs, sex, and other debauchery.

Belfort served 22 months in jail for securities fraud relating to his activities in the 1980s and ’90s with his brokerage firm Stratton Oakmont.

This time out of the gate, Belfort’s take on Wall Street is far less titillating and decidedly more conventional, but “you can thank me when you’re ready to retire, and you have a giant nest egg waiting for you,” he wrote.

Recently, Belfort discussed with Yahoo Finance his simple investing advice like sticking to an S&P 500 index fund, which so far this year is up 7.75% and has gained about 10.7% on average annually since it was introduced in 1957.

Sure it sounds boring, but there are some hot tech stocks along with proven stalwarts in the S&P 500 Index, which includes Microsoft, Amazon, Alphabet, Tesla, Meta, and Berkshire Hathaway.

Edited excerpts:

Oh boy, Jordan, let’s jump right into it. Rage against the machine aside, what’s the overall thesis of your book?

It’s about long-term investing. Picking individual stocks or bonds and trying to beat the market, so to speak, has historically proven to be extremely difficult. People have trouble wrapping their heads around how even a small amount of money over time through long-term compounding, reinvesting dividends, and making small contributions along the way to your portfolio can amount to a truly massive amount of money. You don’t need to make massive returns every single year to have a very, very rich portfolio when you retire.

What makes you crazy about the way Wall Street works, or doesn’t, for the average investor?

It is this two-headed monster. It’s got the useful part where they create massive value and they serve a vital mission function to the US economy. Then they have the not-so-good part.

You’re a huge fan of the S&P 500 Index, quite a leap from your broker days. What’s the magic there?

Here’s why I love it. The S&P index of 500 stocks is this perfect mouse trap capturing the value of the US economy and also the global economy because a great portion of these companies do 34% of their business overseas. You’re getting global exposure to the creation of wealth with the best managers.

Vanguard created this amazing vehicle for the average person anywhere in the world to get all the best out of the value that Wall Street creates and not get sucked into the disastrous allure of short-term trading in the next shiny object. The fact is that human beings, including me, are lousy stock pickers by nature. We sell when we should be buying and buy when we should be selling. The way to protect against this sort of human nature of doing the wrong thing and selling into fear is through indexing.

The S&P 500 Index has been a great investment historically. Over 20 years, it always makes money and it balances out to an annual return of 10.5% give or take a percentage. As you get older, you want to start shifting more into more index bond funds in your portfolio percentage-wise because you want to have less exposure to risk.

How would you advise someone who is stashing away funds for retirement?

Generally speaking, if I were in my thirties or forties, I would have 80% of my money in the S&P 500 Index and maybe 20% in a total bond market index. As you get older, you could start bringing that down to 70/30 and ultimately to 60/40.

Of course, there are other things like your general risk tolerance to consider. But I really love index funds because they take away the guesswork. They protect you from your own worst impulses, which is to trade for the short term and try to pick stocks that are winners. And that’s just really, really hard to do.

Automatically check the box to reinvest your dividends and keep putting money into your funds every month or every quarter as you can, whatever the amount is, whether it’s $25, $50 a month, $100, $500, $1,000, whatever you could afford to do, just keep putting more money into the funds along the way at regular intervals. Don’t even consider the prices you are paying. And ignore if the market is up, down, or sideways.

Jordan, admit it, it’s fun to invest in individual company stocks…

It’s great to take a small percentage of your capital and set it aside for healthy speculation, if you like that stuff, right? It’s fun, and it’s empowering, and it’s great to do that. I just think that you have to set aside a certain amount of capital for that, stick to it, and be ready to lose it.

What’s the investing trap for people?

They think if they only have a small amount to invest that they are never going to get rich. ‘I need to go buy a penny stock where I can hopefully go up a thousand percent and I could make a big hit.’ That’s the trap. They try to time buying a growth stock. ‘I want to buy the next Apple because that’s the only way I’m gonna get rich,’ they say. ‘I’m not gonna get rich buying the S&P 500.’

The answer is it does work out through long-term compounding. But you have to wait until this late stage threshold, which starts at 23, 24 years, and then suddenly you are like, whoa, this stuff actually works. It’s math.

A parting thought?

The Wall Street fee machine con is out there, and it’s very obvious once you recognize what’s going on with these advertisements and propaganda that basically leads people to make decisions that go against their best self-interest.

It’s this wild sort of circus that’s convincing people to stay in this game, this casino, which is really tilted heavily against you. The odds are stacked against you on so many levels.

By the way, if any one of Wall Street’s newfangled ideas hits, guess what? It becomes part of the S&P 500, and you’ll make money.

Kerry Hannon is a Senior Reporter and Columnist at Yahoo Finance. She is a workplace futurist, a career and retirement strategist, and the author of 14 books, including “In Control at 50+: How to Succeed in The New World of Work” and “Never Too Old To Get Rich.” Follow her on Twitter @kerryhannon.

Read the latest financial and business news from Yahoo Finance